Web3 - new yet old

November 2021 • 508 words • 3 min read

Consider these questions:

- How did stock exchanges around the world originate?

- Why do governments allow them to function when they resemble gambling?

- What steps do governments take to keep them relatively safer options for investors?

I think the history of stock markets and these questions are tied to the new web3/crypto/DeFi and its future. After all, promises of shares and tokens are almost the same - communal ownership.1

Dutch East India Company was a special company. It was the first company to issue shares to the general public. Company had a big mission and required a lot of investment. At the same time, the possibility of lucrative dividends was high. As a result, the company’s and its investors’ incentives were aligned.

This was the start of public companies. Quite soon people started trading their shares in the companies. Again incentives were aligned - folks with shares could get liquid money whereas the new shareholders could earn from dividends. Gradually, people were making more money by trading shares than from dividends. They would buy shares at a lower price and sell it to others at a higher price.

People started forming narratives about the companies, they also started studying financial data better to supplement the narrative. However, as it happens in the world, a lot of fraud mechanisms also emerged.2

Now, many of these companies were really important for the economy. Some were developing modern infrastructure and hence governments started creating regulations to protect both companies and investors from these frauds. Today, while fraud has not gone completely to zero, stock exchanges are relatively safer and well-regulated.

If you see, a lot of web3 promises seem to be exactly the same as companies of earlier generations promised via shares.

However, there is very little regulation - well, that’s intentional, after all decentralization is a key foundational pillar and any form of government regulation will be seen as the defeat of the original goal.

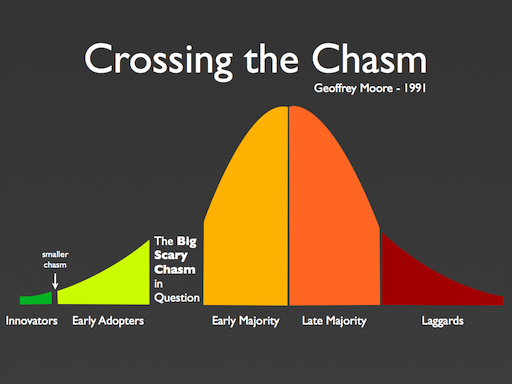

However, there’s a big chasm that web3 still needs to cross3.

From this perspective I see following four distinct scenarios playing out:

- Status Quo - web3 continues to operate without any regulation. Community self organizes and ensures that its true promise is fulfilled.

- Governments get involved - the progressive ones try regulating it accordingly, and a few others ban them. Gradually, it gets to the balance that helps it grow, but with a few compromises.

- Big VC firms, large companies, early believers and lobbyists keep pushing the narrative and pump in users and money. It becomes too big to fail and crosses the chasm. Governments don’t regulate it at all because of various reasons (including political ones)

- Bubble bursts. Everybody except true believers leaves. Chaos settles a bit, and these believers then create infra and use cases that help web3 cross the chasm.

Future is unpredictable. Narratives are linear and have survivor bias. What happens in the world is chaotic and non-linear. Even in web3, pragmatically speaking, a bit of everything will happen.

I do think that web3 tech, while still in its infancy, is quite neat. However, it has a long way to go. I just hope greed, fraud and associated chaos doesn’t hinder web3 from reaching its full potential.

Footnotes

-

To be honest, tokens are in a lot of ways better because they are Internet native, are programmable with smart contracts and a lot more capabilities. ↩

-

A few simple fraud mechanisms were stealing share certificates, exaggerated narratives, pump and dump etc. Surprisingly many of them, in some form, exist in the web3 world too. ↩

-

Web3 critics say that cryptocurrencies haven’t solved any solid use cases even after a decade of existence. Web3 believers however feel that it is still in the infrastructure creation stage, and interesting use cases will be built when the right infra is in place. ↩